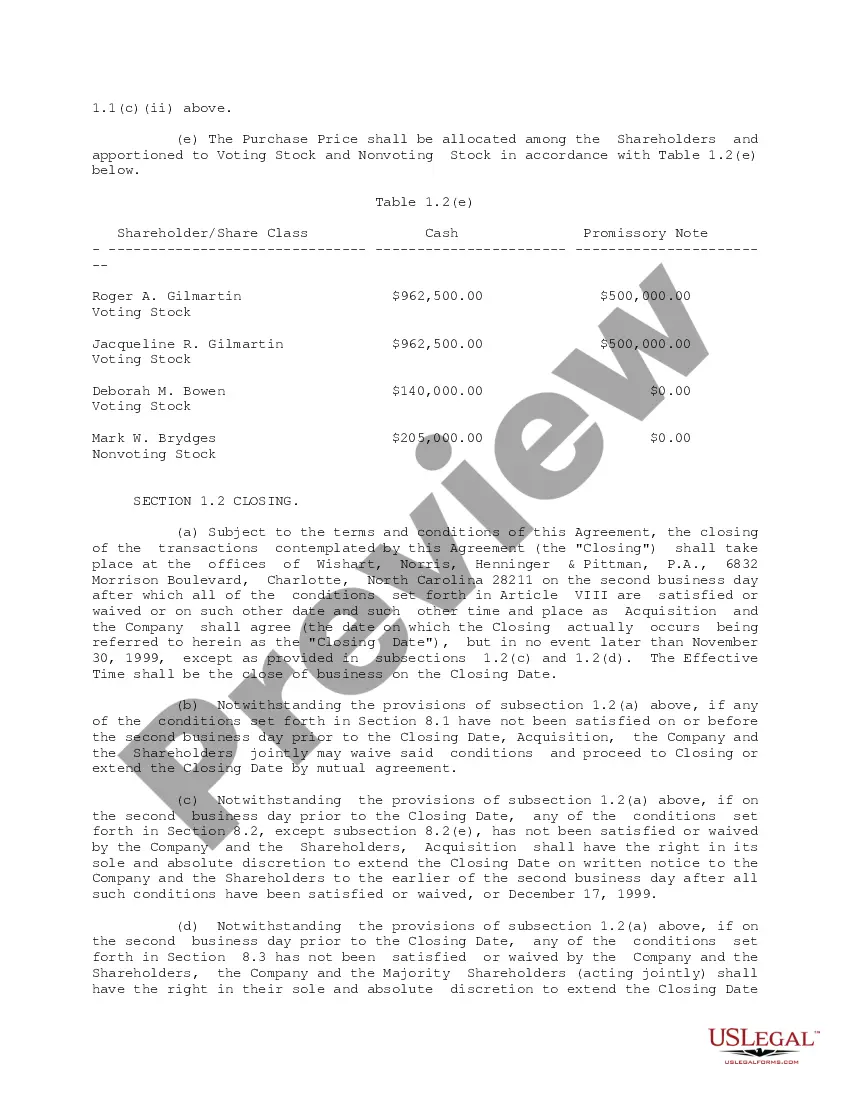

Agreement for Purchase and Sale of stock between GEC Acquisition Corporation, Exigent International, Inc., GEC North America Corporation, Roger A. Gilmartin, Jacqueline R. Gilmartin, Deborah M. Bowen and Mark W. Brydges regarding the acquisition A sale agreement format for a bank loan is a legally binding document that outlines the terms and conditions of the sale of a property or asset when it is used as collateral for a loan from a bank or financial institution. This agreement protects both the lender and the borrower by clearly defining the rights, obligations, and responsibilities of each party involved in the transaction. The sale agreement format for a bank loan typically includes the following key elements: 1. Identification of Parties: The agreement begins by clearly identifying the parties involved, including the lender (bank) and the borrower. 2. Description of Property: The agreement includes a detailed description of the property or asset being used as collateral for the loan. This may include the address, land measurements, and any other relevant details. 3. Sale Consideration: This section outlines the sale consideration, which refers to the agreed-upon value or price at which the property is being transferred to the lender. It may also mention the mode of payment for the sale consideration. 4. Payment Terms: The agreement specifies the payment terms for the loan, including the amount, interest rate, repayment schedule, and any penalties for late payments or default. 5. Delivery of Property: It outlines the process and timeline for the delivery of the property to the lender upon successful completion of the loan agreement. 6. Condition of Property: The agreement may include a clause stating that the property is being sold on an "as-is" basis, meaning it is the responsibility of the borrower to ensure the property is in good condition and free from any encumbrances. 7. Title and Ownership: This section addresses the title and ownership of the property, ensuring that the borrower has clear and marketable title or the right to offer the property as collateral for the loan. 8. Default and Remedies: The agreement outlines the consequences and remedies in case of default by either party, including the lender's right to seize and sell the property to recover the outstanding loan amount. Different types of sale agreement formats for bank loans may exist based on the purpose or type of loan: 1. Mortgage Deed: This format is commonly used when the loan is secured using real estate property, such as land or a house. 2. Hyphenation Agreement: This type of agreement is used when movable assets, such as inventory, machinery, or vehicles, are used as collateral for the loan. 3. Pledge Agreement: When financial assets like stocks, bonds, or certificates of deposit are offered as collateral, a pledge agreement format is used. 4. Bill of Sale: If the loan involves the sale and purchase of goods or equipment, a bill of sale agreement format may be used. In conclusion, a sale agreement format for a bank loan is a critical document that establishes the terms and conditions of the sale of a property or asset when it is used as collateral for a loan. Different types of sale agreement formats exist based on the nature of the collateral, ensuring that both the lender and the borrower are protected throughout the loan transaction.

A sale agreement format for a bank loan is a legally binding document that outlines the terms and conditions of the sale of a property or asset when it is used as collateral for a loan from a bank or financial institution. This agreement protects both the lender and the borrower by clearly defining the rights, obligations, and responsibilities of each party involved in the transaction. The sale agreement format for a bank loan typically includes the following key elements: 1. Identification of Parties: The agreement begins by clearly identifying the parties involved, including the lender (bank) and the borrower. 2. Description of Property: The agreement includes a detailed description of the property or asset being used as collateral for the loan. This may include the address, land measurements, and any other relevant details. 3. Sale Consideration: This section outlines the sale consideration, which refers to the agreed-upon value or price at which the property is being transferred to the lender. It may also mention the mode of payment for the sale consideration. 4. Payment Terms: The agreement specifies the payment terms for the loan, including the amount, interest rate, repayment schedule, and any penalties for late payments or default. 5. Delivery of Property: It outlines the process and timeline for the delivery of the property to the lender upon successful completion of the loan agreement. 6. Condition of Property: The agreement may include a clause stating that the property is being sold on an "as-is" basis, meaning it is the responsibility of the borrower to ensure the property is in good condition and free from any encumbrances. 7. Title and Ownership: This section addresses the title and ownership of the property, ensuring that the borrower has clear and marketable title or the right to offer the property as collateral for the loan. 8. Default and Remedies: The agreement outlines the consequences and remedies in case of default by either party, including the lender's right to seize and sell the property to recover the outstanding loan amount. Different types of sale agreement formats for bank loans may exist based on the purpose or type of loan: 1. Mortgage Deed: This format is commonly used when the loan is secured using real estate property, such as land or a house. 2. Hyphenation Agreement: This type of agreement is used when movable assets, such as inventory, machinery, or vehicles, are used as collateral for the loan. 3. Pledge Agreement: When financial assets like stocks, bonds, or certificates of deposit are offered as collateral, a pledge agreement format is used. 4. Bill of Sale: If the loan involves the sale and purchase of goods or equipment, a bill of sale agreement format may be used. In conclusion, a sale agreement format for a bank loan is a critical document that establishes the terms and conditions of the sale of a property or asset when it is used as collateral for a loan. Different types of sale agreement formats exist based on the nature of the collateral, ensuring that both the lender and the borrower are protected throughout the loan transaction.

Free preview Sample Purchase Agreement Pdf

The Sale Agreement Format For Bank Loan you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Sale Agreement Format For Bank Loan will take you only a few simple steps:

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.